Trends in Marine Insurance: Insights from IUMI’s 150th Annual Conference

The International Union of Marine Insurance (IUMI) held its 150th annual conference in Berlin, Germany, unveiling an in-depth analysis of the latest trends in the marine insurance market. According to their findings, the global marine insurance premium base for 2023 has reached an impressive $38.9 billion, marking a significant increase of 5.9% from the previous year.

Sector-Wise Growth

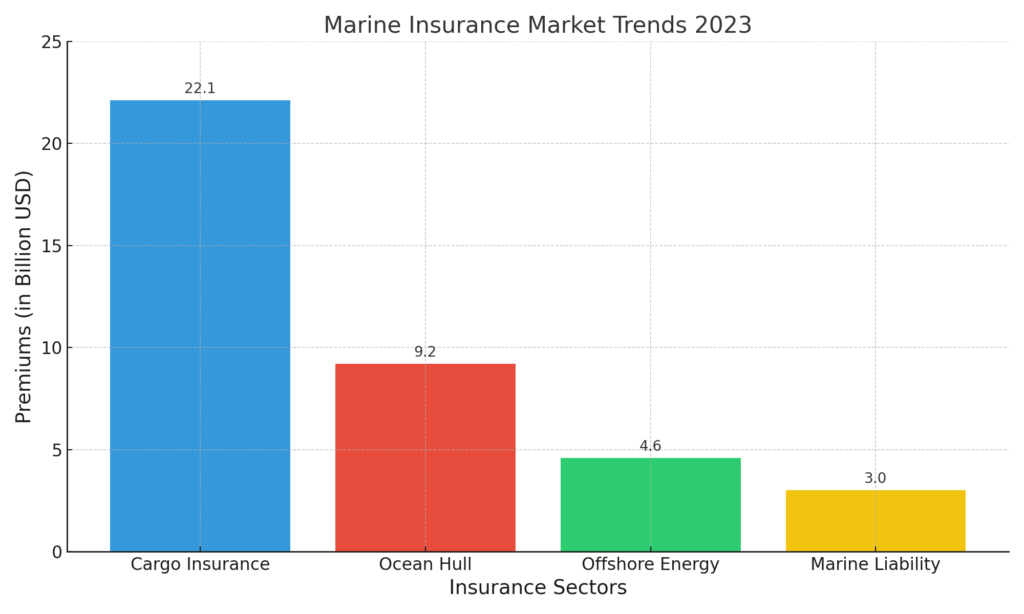

This growth is not limited to one segment; instead, it spans across all lines of business. The offshore energy sector saw a 4.6% rise, while cargo insurance experienced a 6.2% increase, and ocean hull premiums surged by 7.6%. This positive trajectory reflects the overall health of the marine insurance market.

In terms of distribution, cargo insurance continues to dominate, commanding 56.9% of the total premiums, followed by ocean hull at 23.6%, offshore energy at 11.9%, and marine liability at 7.7%.

Regional Insights

When analyzing the premiums by region, Europe maintains its lead, capturing 48.5% of global premiums. The Asia/Pacific region follows with 28.1%, while Latin America accounts for 10.9%, North America for 7.0%, and the rest of the world for 5.5%. Notably, European premiums have shown a steady upward trend since 2019 after a decline, and the Asian market has also been recovering since 2016.

Key Factors Driving Premium Growth

Astrid Seltmann, Vice-Chair of IUMI’s Facts & Figures Committee, pointed out that the increase in premiums is influenced by several factors. The combination of rising global trade volumes and values, coupled with increased vessel values, contributes significantly to the premium uptick. Additionally, fluctuations in oil prices are stimulating activity in the offshore energy sector. Geopolitical factors and market conditions also play a crucial role in shaping these trends.

Seltmann highlighted that, despite individual severe claims causing concern, overall claims have been relatively stable in recent years. However, the marine insurance landscape is evolving with larger vessels, changes in technology and fuels, and alterations to trading routes, necessitating ongoing risk assessment and management.

Challenges Ahead

Jun Lin, Chair of IUMI’s Facts & Figures Committee, addressed the emerging challenges facing the marine insurance industry. Geopolitical tensions, such as the ongoing conflicts in the Red Sea and the Russia-Ukraine war, are disrupting traditional shipping routes. While rerouting vessels around Africa presents new risks, it has also helped absorb the influx of new ships into the market, thereby stabilizing freight rates.

Looking ahead, Lin noted that factors such as the upcoming U.S. elections, climate change, and cyber-risks will also impact the marine insurance market. Nevertheless, he remains optimistic about the resilience of marine underwriters, who have demonstrated adaptability in the face of change.

Certificate in Marine Insurance

Dive into the expansive world of marine insurance with our intensive Certificate in Marine Insurance course, designed for individuals eager to build a solid foundation in this crucial field. This program provides essential insights into the various types of marine insurance available and the vessels they protect, enabling participants to deepen their understanding of the industry.

With a strong focus on the international dimensions of marine insurance, this course cultivates critical awareness and comprehension of the marine insurance market and its operational dynamics. Participants will receive a comprehensive introduction to key concepts, gaining practical insights into major insurance categories such as marine cargo, hull insurance, protection and indemnity (P&I), and other liability coverages, along with an understanding of how these categories interconnect.

Led by seasoned marine insurance experts, our lectures cover all vital aspects of the marine insurance industry, ensuring participants gain a thorough understanding and analysis of essential policies. This equips them to apply their knowledge effectively in real-life scenarios.

Please note that the course is conducted and assessed in English, making it accessible to a global audience. Join us to enhance your skills and advance your career in marine insurance!

Sector-Specific Updates

- Offshore Energy

In the offshore energy sector, global premiums reached $4.6 billion in 2023, up 4.6% from the previous year. The UK continues to be a major player in this market, with Lloyd’s and the International Underwriting Association (IUA) holding substantial shares. The fortunes of this sector closely follow oil prices, which have stabilized, fostering renewed activity. However, despite low claims in recent years, 2023 experienced two significant losses, raising concerns about future performance. - Cargo Insurance

Cargo insurance reported a premium base of $22.1 billion, reflecting a 6.2% increase. All regions enjoyed growth, with Europe and Asia experiencing the most significant improvements. As global trade resumes post-COVID, cargo underwriters have seen favorable loss ratios, although perennial issues like misdeclared cargoes and severe weather events continue to pose challenges. - Ocean Hull

The ocean hull sector saw premiums of $9.2 billion, a 7.6% increase. This sector has benefitted from the resurgence of normal shipping activities post-COVID, which has boosted vessel values. While the frequency of hull claims has risen slightly, it has not exceeded pre-pandemic levels, indicating a cautiously optimistic outlook for the future.

The IUMI conference underscored a year of resilience and growth in the marine insurance industry. As it adapts to evolving challenges and opportunities, the insights from this gathering will play a crucial role in guiding marine underwriters through the complexities of the global maritime landscape. The commitment to continuous improvement and adaptation is evident, promising a robust future for marine insurance.